Receipts Technology Revolutionising Retail and Commerce

Our Receipts Technology brings item-level receipt data to elevate commercial and consumer applications. Our robust data infrastructure ensures secure, bank-grade integration among retail groups, merchants, banks, fintech companies, and their commerce partners, fostering seamless collaboration in the Qatari and the Middle East market.

Products

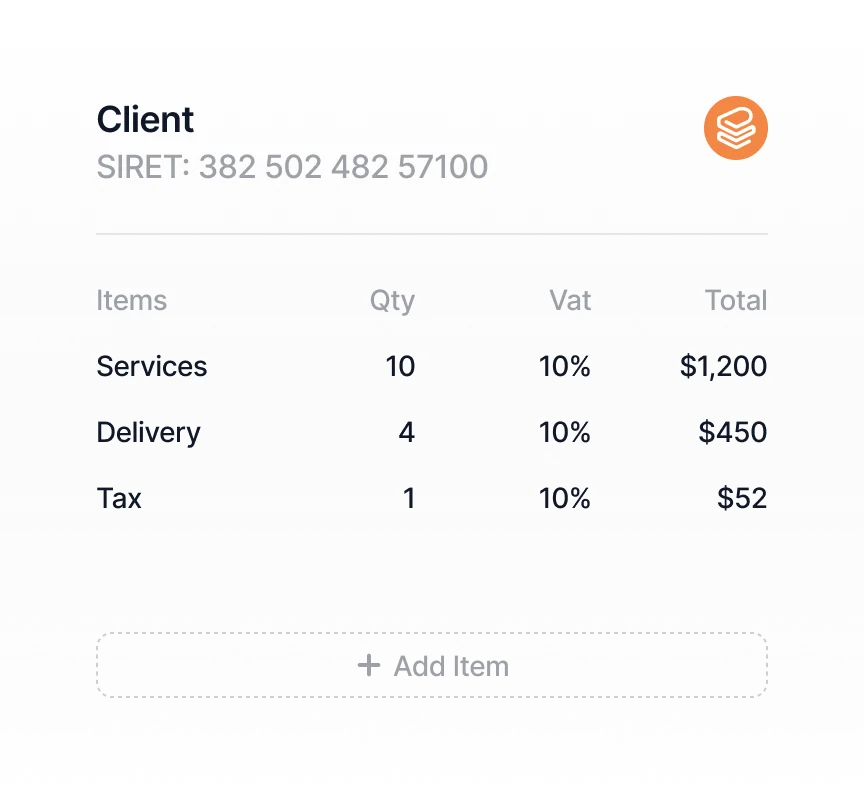

Smart Receipts, Simplified

At Receipts, innovation is at the heart of our mission in Qatar. We understand that every business needs a dependable and efficient platform to enhance its systems. Our receipts platform and solutions are designed to transform receipt processing with a groundbreaking approach unique to the regional data infrastructure, reimagining post-purchase interactions while ensuring that data processing is straightforward, secure, and cost-effective for corporations and businesses — interaction and making data processing simple, secure, and cost-effective.

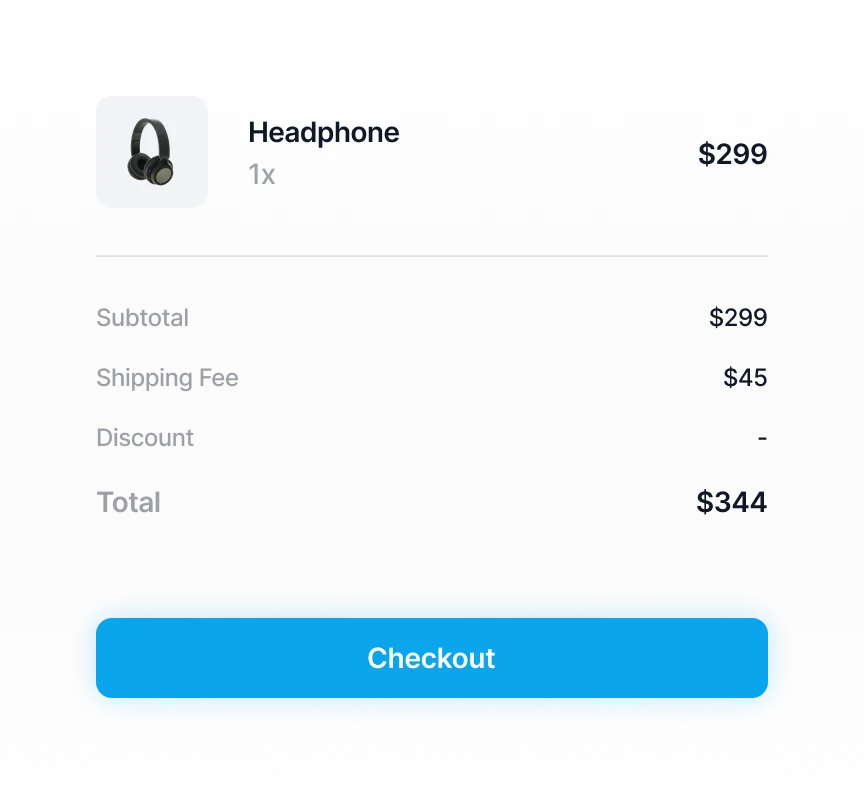

Smart Receipts

Simplified Digital Receipts, sent on customers banking application

Our receipt solutions is directly integrated to a mobile banking app to get your receipts directly on your banking application, our platform seamlessly integrates with your website, online store, or mobile app – unlocking spend level data

Fraudulent Risks and Credit Management

Minimizing Disputes & Chargebacks

Improve transparency for cardholders and optimize agent efficiency in managing fraud disputes and chargebacks by utilizing item-level receipt data within banking applications.

Payments

Enhanced Transaction Data

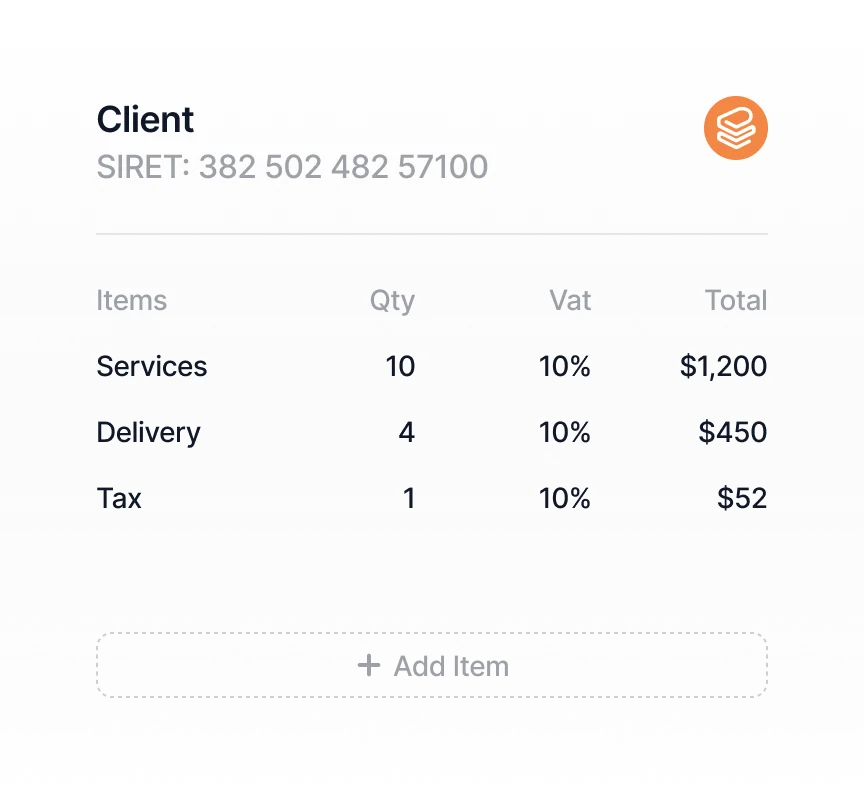

Expense Management:

Integrate business card receipt data into expense platforms to minimize manual reporting, expedite reconciliations, and enhance spend controls, including out-of-policy reimbursements.

Item-Level Payment Reconciliation:

Enhance transaction reconciliation by capturing cardholder and virtual payment details at the item level, optimizing fund management beyond total amounts.

Marketing and Personalisation

Loyalty Marketing and Customer Behavior

Our platform utilizes bank grade technology to analyze SKU-level data, enabling personalized offers tailored to categories, specific brands, products, and exclusions. This approach enhances revenue attribution and significantly increases customer engagement in the Qatari market.

Security

PCI-compliant environment

The store or merchant retains complete ownership and control over its data and its usage in Qatar. We do not share or sell store data to third parties or any external entities. Additionally, payment card information is securely stored in a PCI-compliant system, ensuring the highest level of security for our clients.

Our Receipt Technology is built for accuracy and transparency in SKU data management

Our platform is designed to integrate with accounting softwares, POS and payment gateways.

Features and Benefits

For Partners

Merchants

Increase ROAS in banking marketing channels, optimize operational efficiency, and provide more engaging experiences for both new and returning customers.

Banks

Join us as a partner bank today and provide your customers with smart receipts, allowing them to access smart receipts directly through your banking application.

Payment Service Providers

Itemized receipt data offers significant advantages to payment service providers by providing detailed insights into customer spending habits and purchase patterns.

Technology Partners

The Receipts API provides an effortless solution for expense management platforms, retailer apps, and loyalty programs to access digital receipts directly linked to a customer’s payment card.

Fintechs

Redefining innovation to enhance scalability, we make it easier to unlock receipt data insights and fuel product innovation across both in-store and online experiences.

Card Linked Platforms

Improve the flexibility, value, and revenue attribution of offers to drive greater merchant participation, while enhancing the relevance and engagement of bank cardholder promotions.

Just Released! Our official workshop to level up from UiCore Framework 4 to 5.

Just Released! Our official workshop to level up from UiCore Framework 4 to 5.